Updates to SG & Medicare Levy Surcharge

The government’s 23/24 Federal Budget has released a range of measures including changes and updates to super guarantee and changes to the current Medicare levy surcharge threshold.

Changes to Super Guarantee (SG)

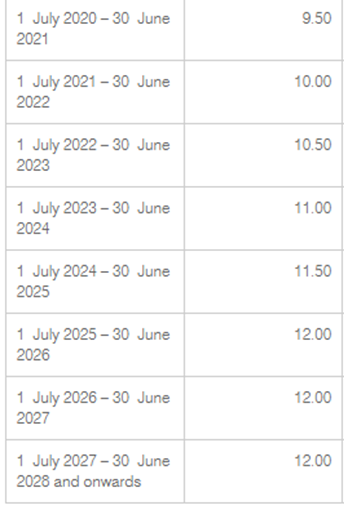

While the minimum surcharge will continue to increase 0.5% every year, The Government will introduce legislation requiring employers to pay super on payday instead of every quarter as is currently the case. This will take effect from 1 July 2026.

The Australian Taxation Office (ATO) will receive additional resourcing to help it detect unpaid super payments earlier and the Government will set enhanced targets for the ATO for the recovery of payments. These changes will improve retirement outcomes for around 8.9 million employees, including young and low-income workers who are most likely to have unpaid super.

Changes to Medicare Levy Surcharge (MLS)

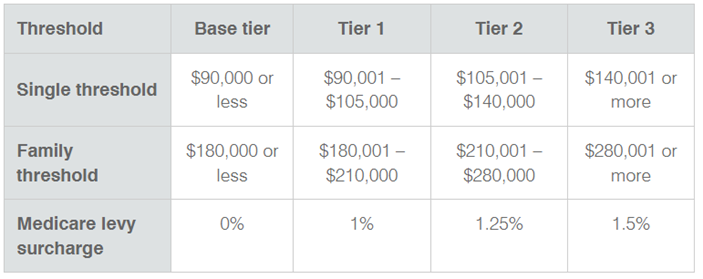

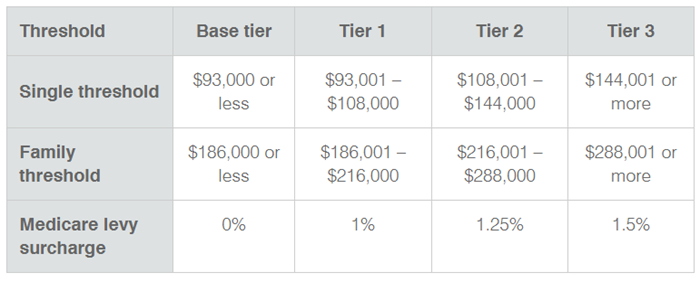

The Government is releasing changes to Medicare levy surcharge thresholds. This is an additional tax (after the normal Medicare tax of 2%) on families and individuals who exceed the thresholds. The tables below show the current thresholds and updated thresholds for the 2023-24 financial year. It is important to be aware of these changes as it may impact your decision to invest in private patient hospital cover – which can exempt families and individuals from MLS.

The post Updates to SG & Medicare Levy Surcharge appeared first on Green Taylor Partners.

More GTP Articles